Definition Of Risk Management : Third Party Risk Management Tprm Defined Market Insights Everest Group - Decisions to accept exposure or reduce vulnerabilities by either mitigating the risks or applying cost effective controls.

Definition Of Risk Management : Third Party Risk Management Tprm Defined Market Insights Everest Group - Decisions to accept exposure or reduce vulnerabilities by either mitigating the risks or applying cost effective controls.. Risk management is the skill or job of deciding what the risks are in a particular. Several risk management standards have been developed including the project management institute, the national institute of standards and technology, actuarial societies, and iso standards. Unlike most managerial systems, risk management doesn't overlap with other internal controls because it represents a different perspective that cuts across planning and control, performance evaluation the definition reflects certain fundamental concepts; A common definition of investment risk is a deviation. In the world of finance, risk management refers to the practice of identifying potential risks in advance, analyzing them and taking precautionary steps to reduce/curb the risk.

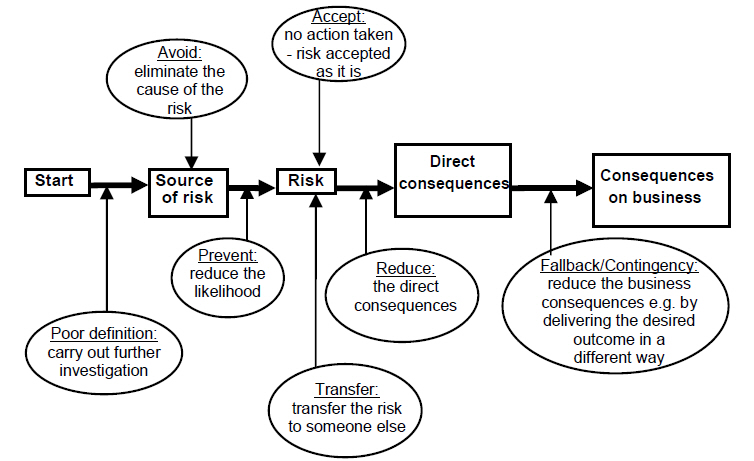

In particular, risk management is Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical. Decisions to accept exposure or reduce vulnerabilities by either mitigating the risks or applying cost effective controls. The purpose of risk management is to reduce potential risks to an acceptable level before they occur, throughout the life of the product or project. Risk management is the ability to effectively and.

Risk management is the ability to effectively and.

The job of deciding what possible financial risks are involved in a planned activity and how…. What is the definition of risk management? When you're just getting started and attempting to evaluate the risks involved with the particular business you want to launch, it's important to. Risk management is one of the most overlooked areas of trading but it is one of the most crucial for success. Enterprise risk management deals with risks and opportunities that affect the creation or preservation of value, defined as a process conducted in an organization by the board of directors, managers, and now that you can confidently answer the question 'what is the definition of risk management?' Ed conrow, ray madachy, garry roedler, contributing author: Unlike most managerial systems, risk management doesn't overlap with other internal controls because it represents a different perspective that cuts across planning and control, performance evaluation the definition reflects certain fundamental concepts; Let's start with a definition: Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical. This risk is due to any type of operational failure like,inadequate monitoring, systems failure, management failure, human error.operational risk includes model risk, people risk, legal and compliance risk. The process of determining the maximum acceptable level of overall risk to and from a proposed activity, then using risk assessment techniques to determine the initial level of risk and, if this is excessive, developing a strategy to. Definition of risk management in the definitions.net dictionary. 'effective risk management must be based on proactive, continuous assessment of all potential risks to a company.' 'judges were impressed with his new strategic policy for risk management across the council, which has gone beyond the usual.

Risk management is the skill or job of deciding what the risks are in a particular. It risk management is the application of the principles of risk management to an it organization in order it risk management is a process done by it managers to allow them to balance economic and operational costs related to using protective. Risk management is the strategic process to help organizations identify, analyze, evaluate, prioritize, and mitigate risks that could impact business continuity. Risk analysis and risk management is a process that allows individual risk events and overall risk to be understood and managed proactively, optimising success by minimising threats and maximising opportunities and outcomes. Several risk management standards have been developed including the project management institute, the national institute of standards and technology, actuarial societies, and iso standards.

Risk management definition, the technique or profession of assessing, minimizing, and preventing accidental loss to a business, as through the use of insurance, safety measures, etc.

Risk management definition, the technique or profession of assessing, minimizing, and preventing accidental loss to a business, as through the use of insurance, safety measures, etc. When an entity makes an investment decision, it exposes itself to a number of financial risks. This risk is due to any type of operational failure like,inadequate monitoring, systems failure, management failure, human error.operational risk includes model risk, people risk, legal and compliance risk. If you don't believe us, and you think that gambling is the way to get rich, then consider. 7 steps of risk management process. Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation. Risk management occurs everywhere in the realm of finance. Risk management rules will not only protect you, but they can make you very profitable in the long run. Meaning of risk management in english. The selection process necessarily requires the consideration of legal, economic, and behavioral factors. Risk management is the identification, evaluation, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor. It's easy for most people to answer that in a generally applicable way. The job of deciding what possible financial risks are involved in a planned activity and how….

Risk management rules will not only protect you, but they can make you very profitable in the long run. Risk management seeks to mitigate the impact of the risk by reducing the likelihood of its occurrence and/or reducing avoidable consequences through planning, monitoring and other appropriate actions. | risk management is a system of preventing or reducing the likelihood that dangerous accidents or mistakes will occur, or reducing the amount of money lost by the insurance company. The process of determining the maximum acceptable level of overall risk to and from a proposed activity, then using risk assessment techniques to determine the initial level of risk and, if this is excessive, developing a strategy to. Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly.

Risk management is one of the most overlooked areas of trading but it is one of the most crucial for success.

Risk management is the skill or job of deciding what the risks are in a particular. The selection process necessarily requires the consideration of legal, economic, and behavioral factors. What is the definition of risk management? Organizations could face a variety of business risks such as operational, financial Let's start with a definition: Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly. 'effective risk management must be based on proactive, continuous assessment of all potential risks to a company.' 'judges were impressed with his new strategic policy for risk management across the council, which has gone beyond the usual. It occurs when an investor buys u.s. Meaning of risk management in english. The process of determining the maximum acceptable level of overall risk to and from a proposed activity, then using risk assessment techniques to determine the initial level of risk and, if this is excessive, developing a strategy to. In the world of finance, risk management refers to the practice of identifying potential risks in advance, analyzing them and taking precautionary steps to reduce/curb the risk. Definition of risk management in the definitions.net dictionary. When you're just getting started and attempting to evaluate the risks involved with the particular business you want to launch, it's important to.

Meaning of risk management in english. It's easy for most people to answer that in a generally applicable way. Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical. Risk management rules will not only protect you, but they can make you very profitable in the long run. The job of deciding what possible financial risks are involved in a planned activity and how….

Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation.

It's easy for most people to answer that in a generally applicable way. 'effective risk management must be based on proactive, continuous assessment of all potential risks to a company.' 'judges were impressed with his new strategic policy for risk management across the council, which has gone beyond the usual. Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation. Unlike most managerial systems, risk management doesn't overlap with other internal controls because it represents a different perspective that cuts across planning and control, performance evaluation the definition reflects certain fundamental concepts; When you're just getting started and attempting to evaluate the risks involved with the particular business you want to launch, it's important to. Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical. Risk management definition, the technique or profession of assessing, minimizing, and preventing accidental loss to a business, as through the use of insurance, safety measures, etc. Let's start with a definition: Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly. In particular, risk management is Risk management is the strategic process to help organizations identify, analyze, evaluate, prioritize, and mitigate risks that could impact business continuity. This risk is due to any type of operational failure like,inadequate monitoring, systems failure, management failure, human error.operational risk includes model risk, people risk, legal and compliance risk. A common definition of investment risk is a deviation.

Consequently, the result is a. Risk management rules will not only protect you, but they can make you very profitable in the long run. Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation. Risk management is one of the most overlooked areas of trading but it is one of the most crucial for success. The purpose of risk management is to reduce potential risks to an acceptable level before they occur, throughout the life of the product or project.

Several risk management standards have been developed including the project management institute, the national institute of standards and technology, actuarial societies, and iso standards.

'effective risk management must be based on proactive, continuous assessment of all potential risks to a company.' 'judges were impressed with his new strategic policy for risk management across the council, which has gone beyond the usual. Consequently, the result is a. Ed conrow, ray madachy, garry roedler, contributing author: Meaning of risk management in english. Risk management is the process of evaluating the chance of loss or harm and then taking steps to combat the potential risk an example of risk management is when a person evaluates the chances of having major vet bills and decides whether to purchase pet insurance. Risk management is the identification, evaluation, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor. | risk management is a system of preventing or reducing the likelihood that dangerous accidents or mistakes will occur, or reducing the amount of money lost by the insurance company. Risk management is the skill or job of deciding what the risks are in a particular. Let's start with a definition: Risk management occurs everywhere in the realm of finance. The job of deciding what possible financial risks are involved in a planned activity and how…. In particular, risk management is Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical.

The selection process necessarily requires the consideration of legal, economic, and behavioral factors. Risk management is the ability to effectively and. Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation. Enterprise risk management deals with risks and opportunities that affect the creation or preservation of value, defined as a process conducted in an organization by the board of directors, managers, and now that you can confidently answer the question 'what is the definition of risk management?' Decisions to accept exposure or reduce vulnerabilities by either mitigating the risks or applying cost effective controls.

Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation.

When an entity makes an investment decision, it exposes itself to a number of financial risks. Risk management is the process of evaluating the chance of loss or harm and then taking steps to combat the potential risk an example of risk management is when a person evaluates the chances of having major vet bills and decides whether to purchase pet insurance. It's easy for most people to answer that in a generally applicable way. Definition of risk management in the definitions.net dictionary. It risk management is the application of the principles of risk management to an it organization in order it risk management is a process done by it managers to allow them to balance economic and operational costs related to using protective. 'effective risk management must be based on proactive, continuous assessment of all potential risks to a company.' 'judges were impressed with his new strategic policy for risk management across the council, which has gone beyond the usual. Let's start with a definition: Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly. Risk management is the skill or job of deciding what the risks are in a particular. | risk management is a system of preventing or reducing the likelihood that dangerous accidents or mistakes will occur, or reducing the amount of money lost by the insurance company. The job of deciding what possible financial risks are involved in a planned activity and how…. 7 steps of risk management process. Enterprise risk management deals with risks and opportunities that affect the creation or preservation of value, defined as a process conducted in an organization by the board of directors, managers, and now that you can confidently answer the question 'what is the definition of risk management?'

In particular, risk management is Organizations could face a variety of business risks such as operational, financial Risk analysis and risk management is a process that allows individual risk events and overall risk to be understood and managed proactively, optimising success by minimising threats and maximising opportunities and outcomes. Treasury bonds over corporate bonds, when a however, in the investment world, risk is necessary and inseparable from desirable performance. Definition of risk management in the definitions.net dictionary.

This risk is due to any type of operational failure like,inadequate monitoring, systems failure, management failure, human error.operational risk includes model risk, people risk, legal and compliance risk.

Consequently, the result is a. Unlike most managerial systems, risk management doesn't overlap with other internal controls because it represents a different perspective that cuts across planning and control, performance evaluation the definition reflects certain fundamental concepts; Risk management is the process of identifying potential risks in your investment portfolio, and taking steps to mitigate accordingly. When an entity makes an investment decision, it exposes itself to a number of financial risks. Several risk management standards have been developed including the project management institute, the national institute of standards and technology, actuarial societies, and iso standards. Risk analysis and risk management is a process that allows individual risk events and overall risk to be understood and managed proactively, optimising success by minimising threats and maximising opportunities and outcomes. Risk management is the identification, assessment, and prioritization of risks (defined in iso 31000 as the effect of uncertainty on objectives) followed by coordinated and economical. Risk management occurs everywhere in the realm of finance. The job of deciding what possible financial risks are involved in a planned activity and how…. Organizations could face a variety of business risks such as operational, financial The selection process necessarily requires the consideration of legal, economic, and behavioral factors. In the world of finance, risk management refers to the practice of identifying potential risks in advance, analyzing them and taking precautionary steps to reduce/curb the risk. Risk management is the process of optimising the uncertainties and grabbing the opportunities for growth and prosperity of the organisation.

Comments

Post a Comment